New push to combine Glencore, Vale mining assets in the Sudbury basin

The news service Reuters is reporting that the long dreamed of merger of Vale and Glencore mining assets in Sudbury basin could happen this year.

“Talks for a Sudbury tie-up have been on and off since 2006, when annual savings were put at more than $500 million, with a number of options being touted for the mining and processing operations in the area,” the Reuters story said.

Brazil-based Vale purchased the former Inco for $19.6 billion in 2006. Talk of combining efforts in the area have surfaced from time to time, and an official with the company raised the issue recently, according to the Reuters story.

“We've got some interesting thoughts on what is possible, (including) tailings (waste) and some of the old areas that could be redone and we are working through that," VBM Chairman Mark Cutifani told Reuters in an interview on the sidelines of the Future Minerals Forum (FMF) mining gathering in Riyadh.

"During the course of this year we should work out whether there's something we can do together or not. Certainly that is one of my priorities."

In an email to CTV News on Thursday, a Vale Base Metals spokesperson said they are always considering opportunities.

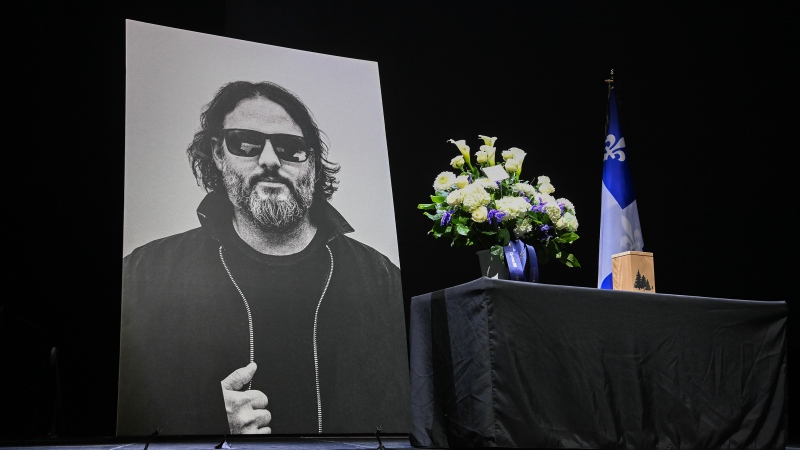

The news service Reuters is reporting that the long dreamed of merger of Vale and Glencore mining assets in Sudbury basin could happen this year. (File)

The news service Reuters is reporting that the long dreamed of merger of Vale and Glencore mining assets in Sudbury basin could happen this year. (File)

“In the normal course of business, we regularly evaluate strategic alternatives and partnerships to create value for our shareholders,” the email said.

“As previously disclosed, we continually assess potential synergies with Glencore’s Nickel Rim Mine in the Sudbury basin.”

A spokesperson for Glencore declined comment.

"We appreciate your question but we do not comment on speculation or rumours," Glencore spokesperson Iyo Grenon said in an email.

Mining analyst Stan Sudol said merging nickel assets in the Sudbury basin is long overdue.

“And with current low metal prices, this is the perfect time for a Sudbury Basin Joint Venture to take advantage of cost synergies,” Sudol said in an email.

He said a major problem in the Sudbury Basin is the mining giants are neighbours in some areas and ore deposits underground cross under these boundaries.

MINING ON OPPOSITE SIDES

“Currently, you could get a situation where two mineshafts and other infrastructure are built on opposite sides of a boundary to access the same large ore deposit,” Sudol said.

“They would need to leave a huge amount of ore untouched or neutralized to create a wide enough distance between both mines, due to provincial mine safety regulations.”

Ore processing is done at each company’s smelters and refineries, both of which run at below capacity.

“Any initiative that saves money and increases ore supply would be very beneficial for the Sudbury Basin,” Sudol said.

“And combining the Sudbury exploration teams of both companies would also considerably help in finding the next generation of local mines.”

Demand for high-grade nickel for the electric vehicle market is growing, and western countries want nickel that is mined ethically.

“Sudbury nickel is clean and green,” he said.

“Sudbury is the largest and longest-producing mining camp in Canada and probably in the No. 2 spot in North America in size, after Nevada’s Carlin Trend. And remember, the polymetallic ore found here not only contains nickel, but copper, cobalt, platinum group metals and gold and silver.”

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

The Reuters story said Vale owns five mines in the area, while Glencore owns the Nickel Rim South mine that is winding down operations after 15 years, and the Onaping Depth project. The assets also produce copper and precious metals.

"It makes sense to do something where we are sharing infrastructure," Cutifani told Reuters.

CTVNews.ca Top Stories

BREAKING Former special forces soldier 'Canadian Dave' taken by the Taliban: sources

David Lavery, a former Canadian special forces solider who helped approximately 100 people flee Afghanistan during the fall of Kabul, has been 'picked up' by the Taliban this week, according to multiple sources who spoke to CTV National News on the condition of anonymity.

Is Canada Post delivering mail today? What to know about the strike

With Canada Post workers on strike, many individuals and businesses are facing the challenge of sending and receiving mail. Here are the answers to some of Canadians’ most-asked questions.

Other countries seeking out advice from Canada ahead of Trump return: Joly

Foreign Affairs Minister Melanie Joly says Donald Trump's return to the White House has boosted Canada's influence in the world as other international partners turn to Canada for advice on how to deal with him.

Tracking respiratory viruses in Canada: RSV, influenza, COVID-19

As the country heads into the worst time of year for respiratory infections, the Canadian respiratory virus surveillance report tracks how prevalent certain viruses are each week and how the trends are changing week to week.

More than 1 in 3 surgical patients has complications, study finds, and many are the result of medical errors

Despite decades of calls for more attention to patient safety in hospitals, people undergoing surgery still have high rates of complications and medical errors, a new study finds.

Federal government overestimating immigration impact on housing gap: PBO

Canada's parliamentary budget officer says the federal government is overestimating the impact its new immigration plan will have on the country's housing shortage.

RFK Jr.'s to-do list to make America 'healthy' has health experts worried

U.S. President Donald Trump's pick of Robert F. Kennedy Jr. for secretary of the Department of Health and Human Services "is an extraordinarily bad choice for the health of the American people," warns the dean of the Brown University School of Public Health.

15 Salisbury University students charged with hate crimes after they allegedly beat a man they lured to an apartment

Fifteen students at Salisbury University in Maryland are facing assault and hate crime charges after they allegedly targeted a man 'due to his sexual preferences' and lured him to an off-campus apartment where they beat him, police said.

Reports of Taylor Swift scams likely run by 'well-organized' fraudsters climbs to 190

Taylor Swift fans eager to score a last-minute ticket should be on alert for scams run by 'well-organized' fraudsters.