Most properties in massive northern Ont. real estate insolvency sold

The 323 most profitable of 407 properties in northern Ontario owned by insolvent real estate companies have been sold.

It's the latest development in the high-profile collapse of a group of 11 companies that owned houses and apartments in Timmins, Sault Ste. Marie, Sudbury, Kirkland Lake, Capreol, Val Caron and Temiskaming Shores.

An excavator was on the scene July 22 at the Kimberly Avenue building, located across from the Living Space Homeless Shelter in Timmins. (Photo from video)

An excavator was on the scene July 22 at the Kimberly Avenue building, located across from the Living Space Homeless Shelter in Timmins. (Photo from video)

The 407 properties had a total of 631 units.

The group was one of the largest real estate owners in northern Ontario when it declared insolvency in January under the Canadian Companies' Arrangement Act.

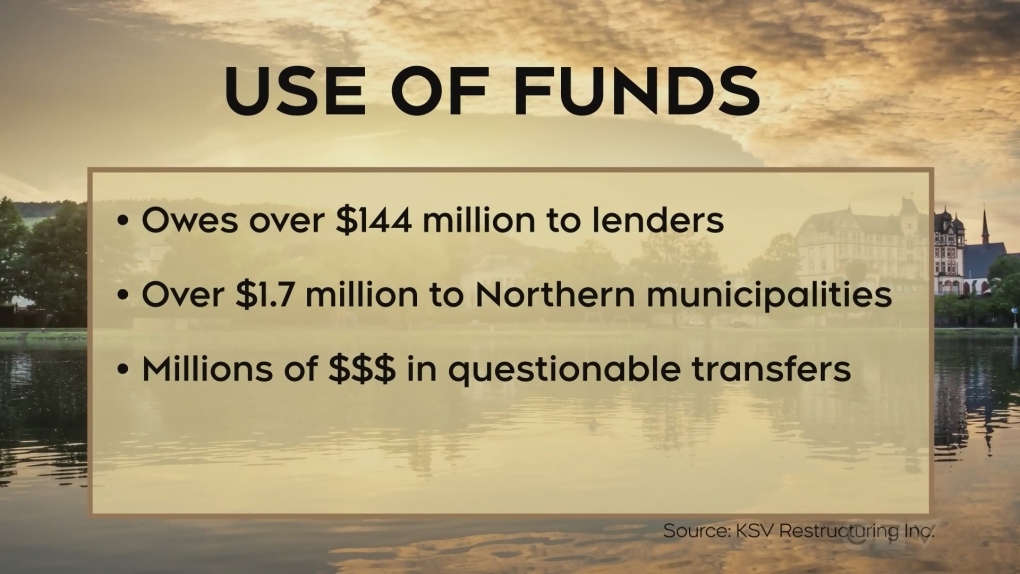

Initial estimates of their debts at the time were as high as $144 million, but KSV Advisory, the firm overseeing the CCAA process, said the actual amount is about $90 million.

Sales of the 323 properties received court approval earlier this month. They were purchased by secured debtors, who submitted credit bids to KSV.

The are required to assume the existing leases on 253 of the properties with tenants.

Revenue from the sales generated $11 million of the $15 million needed to repay loans secured to finance operations during the CCAA process, known as the DIP (debtor-in-possession) lender.

The remaining money will come from a new DIP lender, Viscount Capital Inc., which has also agreed to provide the funds needed to see the process through the sale of the remaining 84 properties.

However, funds generated by the sale of the remaining properties are expected to generate much less revenue.

"Certain of the properties in the remaining portfolio are in extremely poor condition, dilapidated and/or in a state of disrepair," KSV said in its latest report.

More than $144M owed by insolvent real estate investment company to lenders, including more than $1.7M to northern Ontario municipalities. (KSV Restructuring Inc.)

More than $144M owed by insolvent real estate investment company to lenders, including more than $1.7M to northern Ontario municipalities. (KSV Restructuring Inc.)

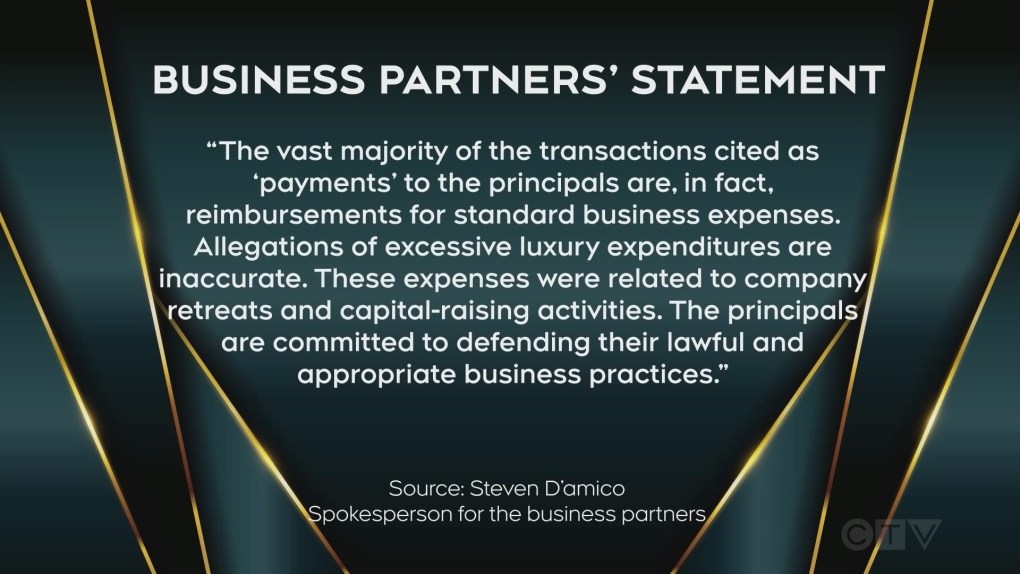

Statement to CTV News on behalf of the insolvent companies about the court-appointed monitor's allegations. (Source: Spokesperson Steven D'amico)

Statement to CTV News on behalf of the insolvent companies about the court-appointed monitor's allegations. (Source: Spokesperson Steven D'amico)

That means they likely won't raise enough money to repay unsecured lenders.

The judge who approved the sale said it was the best option, but would leave many people without compensation.

"No party filed any materials opposing the relief sought," Ontario Superior Court Justice Peter J. Osborne said in his decision dated Dec. 6.

"That said, a number of observers, who has more particularly noted below were secured lenders or unsecured lenders -- individuals and families -- affected by these events, made submissions as to their perspective on the process and the hardship that has been inflicted upon them by the unfortunate circumstances of this case."

Former child actor

KSV is charging $500 an hour for its services, which totalled $416,453 between Aug. 1 and Oct. 31 alone. Legal counsel was provided by Cassels Brock & Blackwell LLP, which charged $1,013 an hour. Legal fees for the same period were $232,717.

Entrepreneurs involved in the now insolvent companies include former YTV child actor Robby Clark, Burlington business owners Aruba Butt and Ryan Molony and Hamilton real estate agent Dylan Suitor.

While the companies told investors they were buying the properties to renovate and rent or sell them at a profit, CCAA documents showed a number of questionable business practices

For example, at least $1 million was spent on luxury purchases and trips that had no relation to the business. A company owned by the directors of the company was paid high fees to oversee the renovations and high dividends were paid despite the companies losing money.

- Download the CTV News app now

- Get local breaking news alerts

- Daily newsletter with the top local stories emailed to your inbox

Osborne said there were many people in the courtroom who were seriously harmed by the insolvency.

"The number of people (real people, individuals and families) who are secured and unsecured lenders and who are adversely affected by this entire situation is significant," he said.

"The impact on them, their lives and their life savings is profound, as was clear from a number of comments made by many of those parties to the court today. I recognize all of those concerns and hardships."

His approval of the sale should not be viewed as "condoning the actions and events that led to the unfortunate situation in which all affected stakeholders find themselves today," Osborne added.

In addition to approving the sales of the 323 properties, the court extended the CCAA proceedings until Feb. 28 to allow time for the remaining properties to be liquidated.

Read the most recent monitor's report here.

CTVNews.ca Top Stories

W5 Investigates Provinces look to Saskatchewan on how to collect millions more for victims of crime

A W5 investigation showed how convicted criminals ordered to pay restitution struggled to do so, and how just $7 million of more than $250 million had been claimed. While many provinces struggle to keep track, Saskatchewan is leading the way in making sure victims get their money.

'Tragic and sudden loss': Toronto police ID officer who died after suspected medical episode while on duty

A police officer who died after having a suspected medical episode on duty was executing a search warrant in connection with an ongoing robbery investigation in North York, Toronto police confirmed Thursday.

Who received the longest jail terms in the Gisele Pelicot rape trial?

A French court found all 51 defendants guilty on Thursday in a mass rape case including Dominique Pelicot, who repeatedly drugged his then wife, Gisele, and allowed dozens of strangers into the family home to rape her.

PM Justin Trudeau planning sizable Friday cabinet shuffle, sources say

Prime Minister Justin Trudeau is planning a sizable cabinet shuffle on Friday, sources confirm to CTV News. The long-awaited reconfiguration of Trudeau's front bench comes amid turmoil for the Liberal government after the shocking resignation of Chrystia Freeland.

Ontario town seeks judicial review after bring fined $15K for refusing to observe Pride Month

An Ontario community fined $15,000 for not celebrating Pride Month is asking a judge to review the decision.

Youth support worker found guilty of sexually assaulting B.C. boy in government care

A former youth support worker has been convicted of sexually assaulting a 14-year-old boy in B.C. government care – an incident that followed months of secret hangouts and shirtless massages that were in clear violation of his employer's policies.

The Royal Family spreads holiday cheer with new Christmas cards

The Royal Family is spreading holiday cheer with newly released Christmas cards.

'Theodore Too' refloated after partial sinking in St. Catharines

The life-size replica of Theodore Tugboat, Theodore TOO, is upright again after suffering a partial sinking Tuesday.

Love, excitement and emotional reunions as holiday travel hits its peak

Air Canada alone estimates it will move two million passengers over the holidays, with Dec. 19 to Dec. 23 being the peak period.