Key facts ahead of vote on LU's plan to pay creditors, emerge from insolvency

On Wednesday, Laurentian University's creditors will vote on a plan to settle those debts and allow the school to emerge from insolvency. Ahead of the meeting, here is some background and more details of how the process works.

LU declared insolvency in February 2021 under the Canadian Companies' Arrangement Act (CCAA) the first time a Canadian university has done so.

Under the CCAA, the university negotiated with creditors to come up with a plan of arrangement – the term for the plan to settle outstanding at a much reduced rate.

Not affected by this process is a group known as secured creditors – groups or individuals owed money by LU that is backed by other resources.

This group includes construction companies such as Forma-Con Construction, which is owed more than $2.5 million.

Lawsuits covered by insurance, such as the $45 million class action suit related to privacy breaches at the university, are not directly part of the Sept. 14 vote. However, if the plan is approved, those claims will be limited to whatever the insurance pays out.

The far bigger group, however, are unsecured creditors. Laurentian owes $181,740,374.13 to more than 500 unsecured creditors.

The biggest single creditor is the Royal Bank of Canada, which is owed $71,603,000, followed by the Toronto Dominion bank, owed $18,418,864.73. Those 500 or so creditors will be voting Sept. 14 on the plan of arrangement. In order for it to be successful, it must receive support from a simple majority of creditors who represent about two-thirds of the total debt.

In recent weeks, some groups opposed to the plan of arrangement have argued voting to reject the plan would mean a new plan would be created with more money.

But a FAQ from the monitor of the process said the opposite is true.

"At that point, the most likely outcome is a liquidation," Ernst & Young said.

"Laurentian expects that it would work under the supervision of the monitor and the court to explore various liquidation options."

Under the plan of arrangement, affected creditors will be paid on 'pro rata' basis. That translates to between 14.1 per cent and 24.2 per cent of what they are owed, depending on the size of their claim and the amount of money available.

In dollar terms, creditors are owed more than $181 million, and they will receive a minimum of $45.5 million and as much as $53.5 million within three years.

That money is coming from the sale of LU's real estate assets to the provincial government, which will allow the university the use of the property.

If the plan of arrangement is not approved, Ernst & Young estimates that creditors would receive a much lower payout -- between 8.5 per cent and 16.7 per cent of what they are owed.

Only affected creditors can attend and vote at the Sept. 14 meeting.

"We expect that a communication will be issued shortly after the meeting providing an update on the outcome of the vote," Ernst & Young said in an email to CTV News.

If the plan is approved, a court hearing will take place Oct. 5 or soon after to formally approve the process and allow LU to emerge from insolvency.

CTVNews.ca Top Stories

Trudeau appears unwilling to expand proposed rebate, despite pressure to include seniors

Prime Minister Justin Trudeau does not appear willing to budge on his plan to send a $250 rebate to 'hardworking Canadians,' despite pressure from the opposition to give the money to seniors and people who are not able to work.

'Mayday!': New details emerge after Boeing plane makes emergency landing at Mirabel airport

New details suggest that there were communication issues between the pilots of a charter flight and the control tower at Montreal's Mirabel airport when a Boeing 737 made an emergency landing on Wednesday.

Cucumbers sold in Ontario, other provinces recalled over possible salmonella contamination

A U.S. company is recalling cucumbers sold in Ontario and other Canadian provinces due to possible salmonella contamination.

Latest updates: Tracking RSV, influenza, COVID-19 in Canada

As the country heads into the worst time of year for respiratory infections, the Canadian respiratory virus surveillance report tracks how prevalent certain viruses are each week and how the trends are changing week to week.

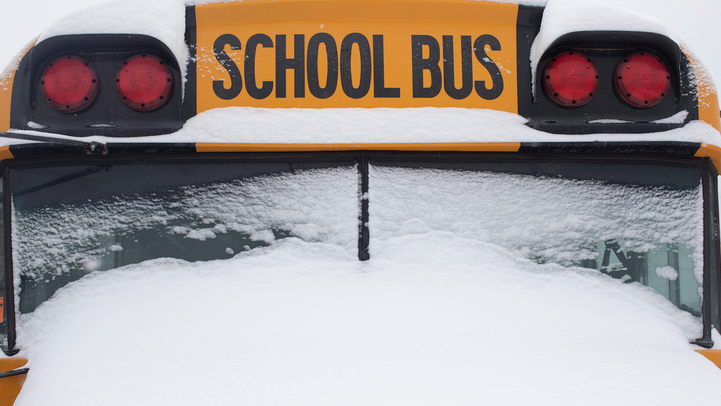

Weekend weather: Parts of Canada could see up to 50 centimetres of snow, wind chills of -40

Winter is less than a month away, but parts of Canada are already projected to see winter-like weather.

W5 Investigates A 'ticking time bomb': Inside Syria's toughest prison holding accused high-ranking ISIS members

In the last of a three-part investigation, W5's Avery Haines was given rare access to a Syrian prison, where thousands of accused high-ranking ISIS members are being held.

Federal government posts $13B deficit in first half of the fiscal year

The Finance Department says the federal deficit was $13 billion between April and September.

Armed men in speedboats make off with women and children when a migrants' dinghy deflates off Libya

Armed men in two speedboats took off with women and children after a rubber dinghy carrying some 112 migrants seeking to cross the Mediterranean Sea started deflating off Libya's coast, a humanitarian aid group said Friday.

Nick Cannon says he's seeking help for narcissistic personality disorder

Nick Cannon has spoken out about his recent diagnosis of narcissistic personality disorder, saying 'I need help.'