Two northern Ont. gold mines to merge, creating one of Canada's largest

Two northern Ontario gold mines are planning to become one creating "one of the largest and lowest cost gold mines in Canada" and saving US$515 million over the life of the operations.

Alamos Gold announced its intention to buy Argonaut Gold in a news release Wednesday morning.

Gold from Island Gold mine in Dubreuilville, Ont. (Alamos Gold)

Gold from Island Gold mine in Dubreuilville, Ont. (Alamos Gold)

The agreement was unanimously approved by the boards of directors for both companies, the release said, and Argonaut's two largest shareholders have entered into "lock-up agreements."

Both have mining operations in the town of Dubreuilville, located nearly 300 kilometres north of Sault Ste. Marie.

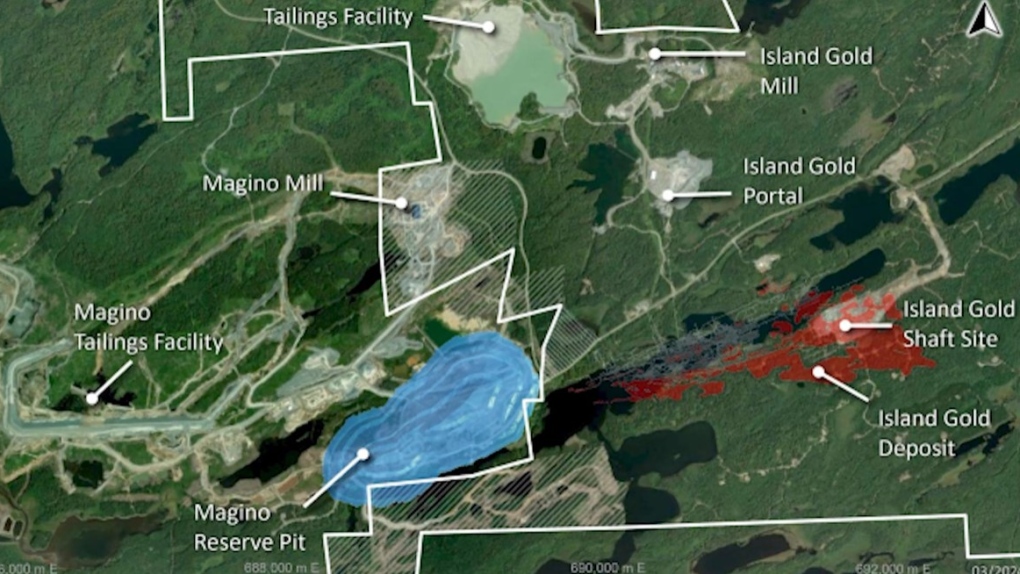

Argonaut's Magino mine is adjacent to Alamos' Island Gold mine.

Map of Magino and Island Gold mines in Dubreuilville. (Alamos Gold)

Map of Magino and Island Gold mines in Dubreuilville. (Alamos Gold)

"Through the use of shared infrastructure, Alamos expects to unlock significant value with immediate and long-term synergies expected to total approximately US$515 million," Alamos said.

"This includes operating synergies of US$375 million, through the use of the larger centralized mill and tailings facility at Magino, and capital savings of US$140 million with the mill and tailings expansions at Island Gold no longer required."

The combined gold production is expected to increase by approximately 25 per cent to more than 600,000 ounces per year with potential to grow further to more than 900,000 ounces per year.

The production increase is expected to come after the Phase 3+ expansion is complete in 2026.

"The two deposits contain mineral reserves of 4.1 million ounces, and total mineral reserves and resources of 11.5 million ounces supporting a mine life of more than 19 years, with significant exploration upside," Alamos said.

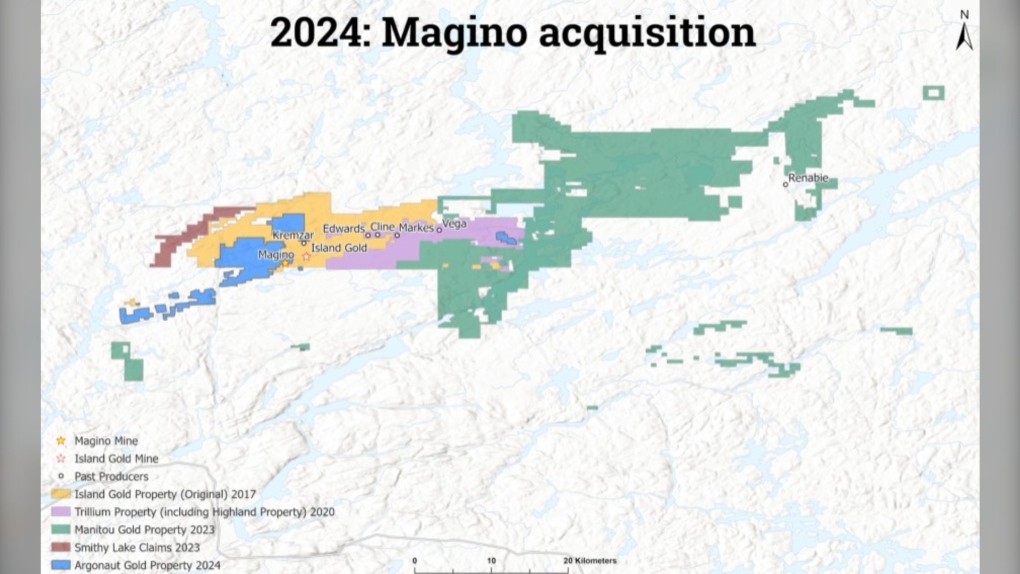

Evolution of land position within the Michipicoten Belt, Ontario (Alamos Gold)

Evolution of land position within the Michipicoten Belt, Ontario (Alamos Gold)

Argonaut's U.S. and Mexico assets will be "spun out to its existing shareholders as a newly created junior gold producer SpinCo."

This includes the Florida Canyon mine, the El Castillo Complex, the La Colorada operation and the Cerro del Gallo project.

"Under the terms of the agreement, each Argonaut common share outstanding will be exchanged for 0.0185 Alamos common shares and 1 share of SpinCo," Alamos said.

"With 88 per cent of the combined company’s net asset value supported by its Canadian assets, solidifying Alamos’ position as the 3rd-largest gold producer in Canada."

For the purchase to go through, 66.67 per cent approval during an Argonaut shareholder vote is needed.

Argonaut's two largest shareholders represent a 40 per cent interest and have already entered into lock-up agreements in support of the purchase. Its directors and senior management have also entered into support agreements.

A special meeting is expected to be held in June.

"In addition to shareholder and court approvals, the transaction is subject to applicable regulatory approvals and the satisfaction of certain other closing conditions customary for a transaction of this nature," the news release said.

"Additionally, a break fee in an amount of C$20 million is payable to Alamos by Argonaut in certain circumstances, if the transaction is not completed, and an expense reimbursement fee is payable by Alamos to Argonaut in certain circumstances if the transaction is not completed."

CTVNews.ca Top Stories

From essential goods to common stocking stuffers, Trudeau offering Canadians temporary tax relief

Canadians will soon receive a temporary tax break on several items, along with a one-time $250 rebate, Prime Minister Justin Trudeau announced Thursday.

She thought her children just had a cough or fever. A mother shares sons' experience with walking pneumonia

A mother shares with CTVNews.ca her family's health scare as medical experts say cases of the disease and other respiratory illnesses have surged, filling up emergency departments nationwide.

Trump chooses Pam Bondi for attorney general pick after Gaetz withdraws

U.S. president-elect Donald Trump on Thursday named Pam Bondi, the former attorney general of Florida, to be U.S. attorney general just hours after his other choice, Matt Gaetz, withdrew his name from consideration.

Putin says Russia attacked Ukraine with a new missile that he claims the West can't stop

Russian President Vladimir Putin announced Thursday that Moscow has tested a new intermediate-range missile in a strike on Ukraine, and he warned that it could use the weapon against countries that have allowed Kyiv to use their missiles to strike Russia.

Here's a list of items that will be GST/HST-free over the holidays

Canadians won’t have to pay GST on a selection of items this holiday season, the prime minister vowed on Thursday.

A one-of-a-kind Royal Canadian Mint coin sells for more than $1.5M

A rare one-of-a-kind pure gold coin from the Royal Canadian Mint has sold for more than $1.5 million. The 99.99 per cent pure gold coin, named 'The Dance Screen (The Scream Too),' weighs a whopping 10 kilograms and surpassed the previous record for a coin offered at an auction in Canada.

Video shows octopus 'hanging on for dear life' during bomb cyclone off B.C. coast

Humans weren’t the only ones who struggled through the bomb cyclone that formed off the B.C. coast this week, bringing intense winds and choppy seas.

Taylor Swift's motorcade spotted along Toronto's Gardiner Expressway

Taylor Swift is officially back in Toronto for round two. The popstar princess's motorcade was seen driving along the Gardiner Expressway on Thursday afternoon, making its way to the downtown core ahead of night four of ‘The Eras Tour’ at the Rogers Centre.

Service Canada holding back 85K passports amid Canada Post mail strike

Approximately 85,000 new passports are being held back by Service Canada, which stopped mailing them out a week before the nationwide Canada Post strike.