Sault Taoist temple loses fight for tax-free designation

A Taoist temple with locations across Ontario – including Sault Ste. Marie – has lost a court battle in which the temple sought a religious exemption to municipal property taxes. (File)

A Taoist temple with locations across Ontario – including Sault Ste. Marie – has lost a court battle in which the temple sought a religious exemption to municipal property taxes. (File)

A Taoist temple with locations across Ontario – including Sault Ste. Marie – has lost a court battle in which the temple sought a religious exemption to municipal property taxes.

At issue was a Municipal Property Assessment Corporation (MPAC) decision that said certain properties used by the temple weren't eligible for the tax exemption because they were being used for 'evangelizing.'

The Fung Loy Kok (FLK) Institute of Taoism operates around 20 temples in Ontario, including one on Cunningham Road in the Sault.

Under Ontario's Assessment Act, properties used for religious services are exempt, but not ones used to gain new converts.

"The act provides that land that is owned by a religious organization is exempt from municipal taxation if it is a place of worship," said a transcript from the Ontario Superior Court of Justice.

While MPAC granted a tax exemption for most of the FLK lands, some properties designated 'satellite sites,' were eligible for taxation.

"The satellite sites are lands where FLK conducts Taoist tai chi classes," the court transcript said.

"Initial classes are given for free. After the first free class, participants pay a fee for subsequent classes. The application judge found these properties were not entitled to be classified as exempt under the Act."

Lawyers for FLK argued MPAC committed three errors in making the decision, including viewing the temple through "an impermissible Judaeo-Christian lens."

But the heart of their argument focused on what constitutes worship under terms of the Assessment Act.

"FLK argues that adherents are 'worshiping' when they are attending the satellite sites," the transcript said.

A previous appeals judge ruled that activity on the satellite sites amounted to evangelical work – recruiting new people to become members – rather than active worship.

"The application judge engaged in an impermissible inquiry by relying on the evidence of the affiant for MPAC, which emphasized an evangelical nature of the activities," the transcript said.

"This came from evidence about the degree to which instructors at the sites focused on personal physical health of the participants rather than acts of worship."

MPAC argued that to qualify for tax-free status, it's not enough that some religious activities take place on the property.

"In order to create an exemption for those properties, those activities must constitute acts of worship, a more narrow form of activity than the simple act of conducting a practice that has religious connotation," the court said.

The court also rejected the idea of a Judeo-Christian bias, ruling that it's not their job to evaluate religious practice but to apply the law.

"This case is not about validating or invalidating forms of religious practice," the transcript said.

"It is about deciding if a particular acknowledged religious practice, occurring at the satellite sites, constitutes acts of worship such that it can be granted an exemption."

For example, under the legislation, Christian church buildings are treated differently from graveyards.

"An act of worship may well occur at a graveside or in a churchyard," the transcript said. "Yet the other things that are easily understood to occur in a place like a graveyard would displace worship as a primary purpose."

And for the purposes of taxation, the initial appeals judge ruled that activity at the satellite sites was not eligible for tax-free status.

"The application judge agreed with the MPAC position that people were not worshipping while doing tai chi at the satellite sites," the transcript said.

"It was open for her to make that determination on the evidence before her. She found the acts to be in the nature of evangelization. Evangelization is a religious practice … however, it is not one that the (Ontario) legislature has deemed to attract an exemption."

The appeal was dismissed and FLK will have to pay MPAC a total of $17,000 for court costs.

Read the full transcript here.

CTVNews.ca Top Stories

'One of the single most terrifying things ever': Ontario couple among passengers on sinking tour boat in Dominican Republic

A Toronto couple are speaking out about their 'extremely dangerous' experience on board a sinking tour boat in the Dominican Republic last week.

What Canadians think of the latest Liberal budget

A new poll suggests the Liberals have not won over voters with their latest budget, though there is broad support for their plan to build millions of homes.

opinion Why you should protect your investments by naming a trusted contact person

Appointing a trusted person to help with financial obligations can give you peace of mind. In his personal finance column for CTVNews.ca, Christopher Liew outlines the key benefits of naming a confidant to take over your financial responsibilities, if the need ever arises.

Teacher shortages see some Ontario high school students awarded perfect grades on midterm exams

Students at a high school in York Region have been awarded perfect marks on their midterm exams in three subjects – not because of their academic performances however, but because they had no teacher.

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.

Photographer alleges he was forced to watch Megan Thee Stallion have sex and was unfairly fired

A photographer who worked for Megan Thee Stallion said in a lawsuit filed Tuesday that he was forced to watch her have sex, was unfairly fired soon after and was abused as her employee.

Ottawa injects another $36M into vaccine injury compensation fund

The federal government has added $36.4 million to a program designed to support people who have been seriously injured or killed by vaccines since the end of 2020.

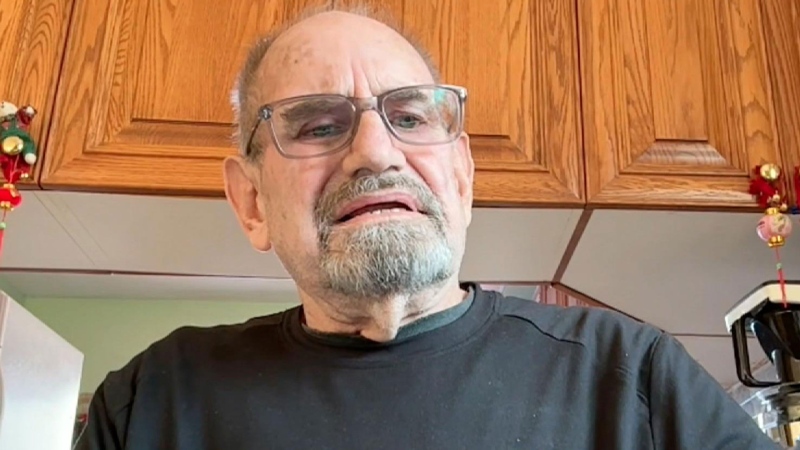

An Ontario senior thought he called Geek Squad for help with his printer. Instead, he got scammed out of $25,000

An Ontario senior’s attempt to get technical help online led him into a spoofing scam where he lost $25,000. Now, he’s sharing his story to warn others.

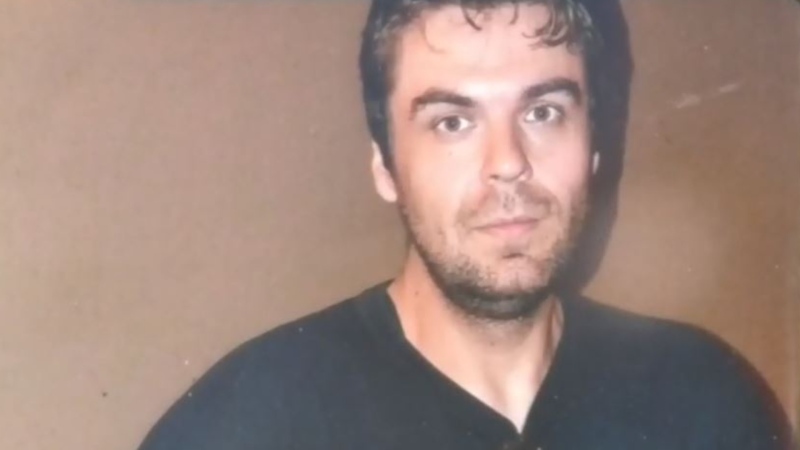

Her fiance has been in prison for 49 years. She's trying to free him before it's too late

Christine Roess is a retired consultant. Ezra Bozeman has spent the last 49 years in prison, serving a life sentence for a murder he says he didn’t commit. Against the odds, the two fell in love.