Insolvent northern Ont. real estate group accused of misusing tens of millions of dollars

A former child actor and his business partners with major real estate holdings in northern Ontario have been facing insolvency after failing to keep up with debts meant for buying and renovating hundreds of properties.

A court-appointed monitor claimed recently that the business partners had been misusing tens of millions of dollars.

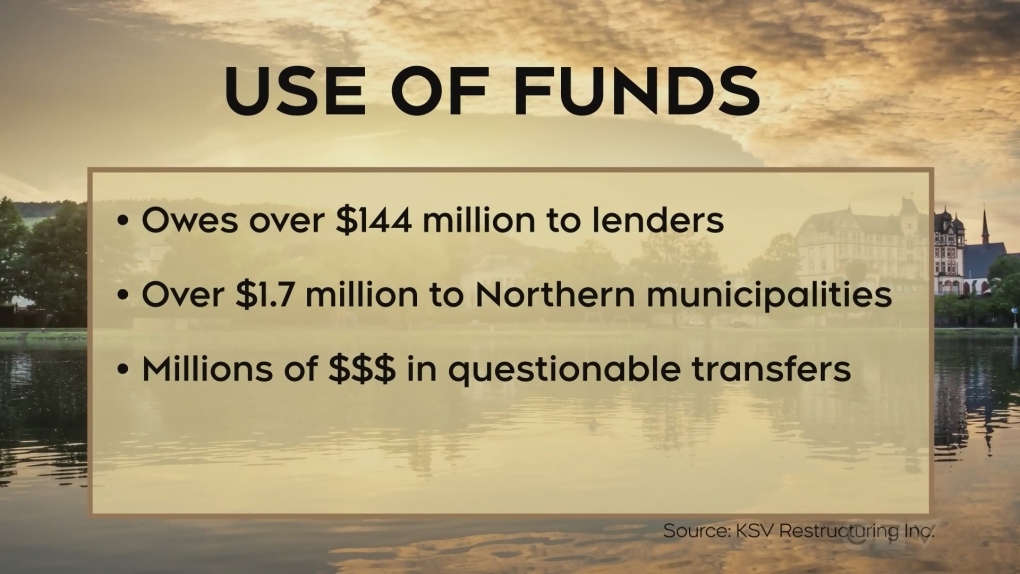

More than $144M owed by insolvent real estate investment company to lenders, including more than $1.7M to northern Ontario municipalities. (KSV Restructuring Inc.)

More than $144M owed by insolvent real estate investment company to lenders, including more than $1.7M to northern Ontario municipalities. (KSV Restructuring Inc.)

This insolvency battle involves a group of 11 companies with names like 'Happy Gilmore Incorporated' and 'The Pink Flamingo' and their struggle to pay back hundreds of loans and investments, totalling more than$144 million.

The money was meant to purchase, maintain and renovate more than 600 properties, most of them in the northern Ontario region, but recent court documents suggest the companies' spending habits contributed to their financial crisis.

The entrepreneurs in question are former YTV child actor Robby Clark, Burlington business owners Aruba Butt and Ryan Molony and Hamilton real estate agent Dylan Suitor.

They filed for creditor protection in January, blaming higher interest rates, but court-appointed monitor RSV Restructuring said that’s not the full story, reporting last week that the business partners were spending their millions in ways not intended by their lenders.

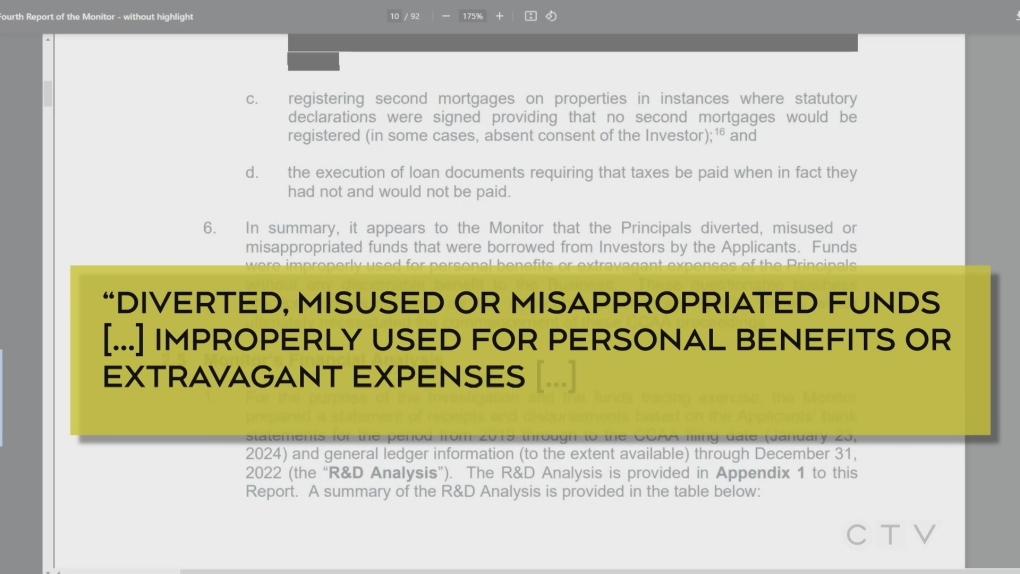

Allegations against insolvent group of real estate companies include 'diverted, misused or misappropriated funds.' (RSV Restructuring insolvency report)

Allegations against insolvent group of real estate companies include 'diverted, misused or misappropriated funds.' (RSV Restructuring insolvency report)

Out of the $144 million owed -- with more than $1.7M of which to northern municipalities -- the report cited millions of dollars in "questionable transfers" both between the applicant companies and others and hefty dividend payments to themselves, all without clear explanations.

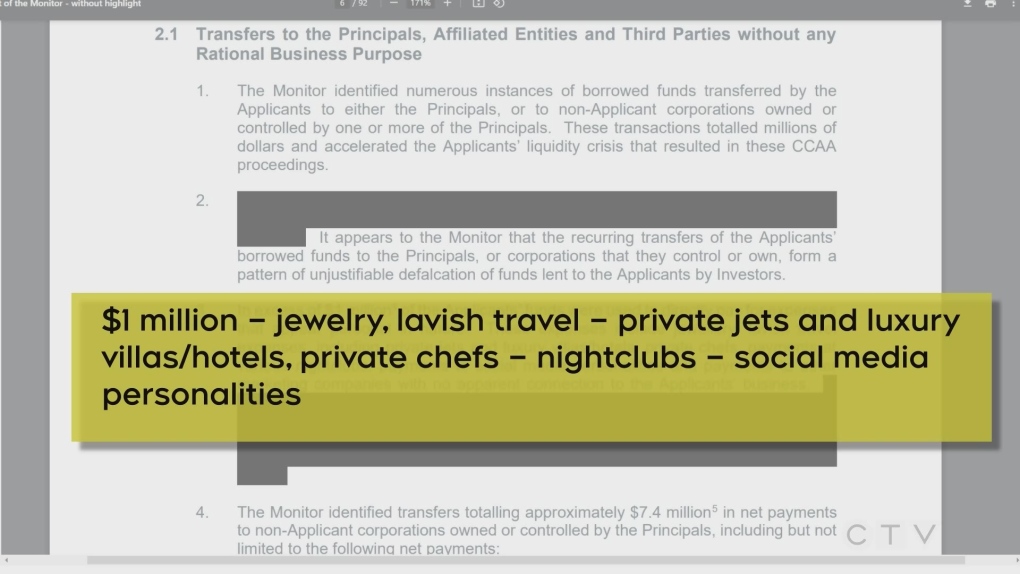

The report also cites more than $1 million spent on jewelry, lavish travel with private jets, luxury hotels and villas, private chefs, nightclub outings and payments to social media personalities.

Court-appointed insolvency monitor claims real estate group misused $1 million for lavish expenses. (RSV Restructuring insolvency report)

Court-appointed insolvency monitor claims real estate group misused $1 million for lavish expenses. (RSV Restructuring insolvency report)

Much of this appears to have taken place while the companies were in their deepest states of financial trouble, all the while posting swanky scenes to social media.

The report characterized the behaviour as evidence of either "an extreme lack" of business knowledge or "diverted, misused or misappropriated funds […] improperly used for personal benefits or extravagant expenses […] without any discernable benefit to the business."

It also said investors were unaware the whole time.

The business partners' public relations team sent CTV News a statement disputing the report’s findings, adding that key evidence was omitted which contradicts it.

"The vast majority of the transactions cited as 'payments' to the principals are, in fact, reimbursements for standard business expenses," the statement reads.

"Allegations of excessive luxury expenditures are inaccurate. These expenses were related to company retreats and capital-raising activities. The principals are committed to defending their lawful and appropriate business practices."

Statement to CTV News on behalf of the insolvent companies about the court-appointed monitor's allegations. (Source: Spokesperson Steven D'amico)

Statement to CTV News on behalf of the insolvent companies about the court-appointed monitor's allegations. (Source: Spokesperson Steven D'amico)

Under their creditor protection, the companies will undergo restructuring, including gradually selling their properties to pay back lenders.

Any lawsuits against them are on hold until the process is complete.

CTVNews.ca Top Stories

'I'm not leaving': Biden meets with top Democrats, rejects calls to abandon campaign

U.S. President Joe Biden vowed to stay in the 2024 presidential race during a call with campaign staff on Wednesday and sought to reassure top Democrats on Capitol Hill that he is fit for reelection despite his shaky debate performance last week.

'Not my finest moment:' Police called to dispute between Ottawa city councillor and daycare owner

Ottawa city councillor Clarke Kelly says he is not apologizing after a Kinburn daycare owner alleged he screamed and swore in front of children during a dispute that saw police called to the scene on Wednesday afternoon.

Is Greece's six-day work week an option in Canada? An expert weighs in

As some Canadian companies explore offering staff a four-day work week, experts are watching Greece's move closely and suggest it could work in Canada.

Irish prime minister 'appalled' by Montrealer's death after alleged assault

Ireland's prime minister says he's "absolutely appalled" by an assault in the country's capital that resulted in the death of a tourist from Montreal.

Ontario man suffers cardiac arrest in Florida. This is why insurance won't cover his $620,000 hospital bill

An Ontario man who wanted to spend time with his family in Florida was hospitalized after suffering a cardiac arrest at the airport as he was about to fly back to Canada.

No tsunami threat after multiple earthquakes recorded off Vancouver Island

Five earthquakes were recorded in quick succession off the British Columbia coast on Wednesday afternoon.

Hudson's Bay Co. to purchase U.S. department store Neiman Marcus: reports

Hudson's Bay Co. has reached a deal to buy luxury department store chain Neiman Marcus, according to media reports.

Trudeau focused on governing, fighting right-wing populism following byelection loss

Prime Minister Justin Trudeau has been taking calls from different members of his Liberal caucus following the party's historic byelection loss in a Toronto riding last week, but the prime minister said his focus remains on governing.

Canadian feels 'abandoned' in Mexico after WestJet strike

More than 1,100 WestJet flights and counting have been cancelled since last Thursday, when a strike by the airlines mechanics union grounded travel plans for more than 100,000 customers.