Has inflation increased your debt?

Inflation is now forcing some Canadians to find different ways to afford day-to-day expenses.

The amount of credit card debt among Canadians has tripled in the last two years - per Stats Canada.

Economists say lower-income Canadians are turning to credit cards with high-interest rates to pay for the necessities and now, those people need help.

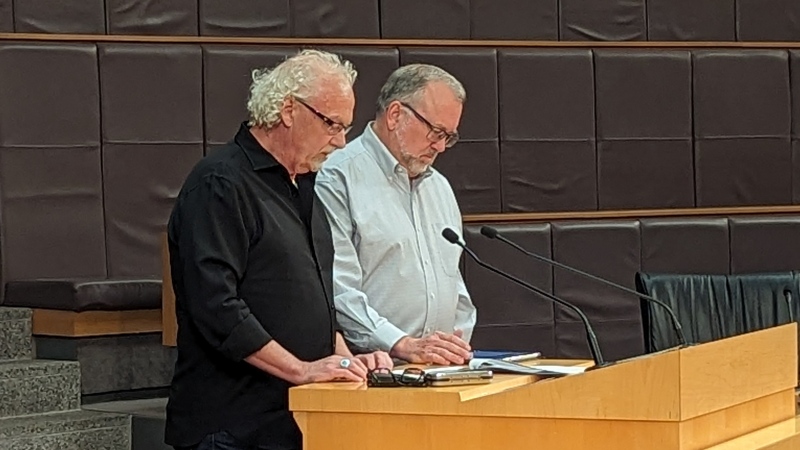

Joel Grisé is a Licensed Insolvency Trustee at Fontaine and Associates in North Bay.

He told CTV News the need for his services is skyrocketing.

“The phone stopped ringing in March of 2020 and didn’t pick up until, I’m going to say January that’s just come by,” Grisé said.

“Right now I’m having a hard time keeping up with phone calls.”

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

For those who have experienced credit card debt know it is a stressful situation – but experts say it also comes with many lessons.

“We regretted it because we were in debt there for a while after racking up our credit cards,” a Sault native told CTV News.

“We went over to Credit Counseling and we used their services and paid off our debt.”

Another Sault resident said it didn’t him long to find himself “in the hole.”

“I got my first credit card, eligible up to 2,500. I maxed that out in probably three months.”

The 23-year-old is in the process of paying off that debt and said he has received some good advice since then.

“They told me whatever you spend on your credit card to just immediately pay it back with your cash or your debit,” he said.

Grisé said with the right habit changes and a plan from someone like himself, some can eliminate their debt in as little as nine months.

Though swiping or tapping a credit card may be easiest when shopping, he said it is not how financial experts recommend you do it.

“They can do more harm than good,” Grisé said.

“And if you want a little bit of education, if you use credit or debit, you’re going to spend 13 per cent more than if you use cash.”

Debt experts said that while everyone’s financial situation varies – if a person owes more than $5,000 or has been trying unsuccessfully to get out of debt for more than two years they may want to seek help and talk to an expert.

CTVNews.ca Top Stories

BREAKING Alice Munro, Nobel literature winner revered as short story master, dead at 92

Nobel laureate Alice Munro, the Canadian literary giant who became one of the world’s most esteemed contemporary authors and one of history's most honored short story writers, has died at age 92.

Latest updates on air quality alerts, and when the smoke may reach Ontario and Quebec

Wildfires have led Environment Canada to issue air quality advisories for parts of B.C., Alberta, Manitoba, Saskatchewan and the Northwest Territories, as forecasters warn the smoke could drift farther east.

Are these Canada's best restaurants? Annual top 100 list revealed

The annual list of Canada's top restaurants in the country was just released and here are the places that made the 2024 cut.

Attack on prison van in France kills 2 officers, inmate escapes

Armed assailants killed two French prison officers and seriously wounded three others in an attack on a convoy in Normandy on Tuesday and an inmate escaped, officials said.

Steal a car, lose your driver's licence for 10 years under new Ontario proposal

Repeat car thieves may face lengthy licence bans under proposed changes to Ontario’s Highway Traffic Act.

B.C. brings in law on name changes on day that child killer's new identity revealed

The BC NDP have tabled legislation aimed at stopping people who have committed certain heinous acts from changing their names.

Significant police presence as Israeli flag flies at Ottawa City Hall

The Israeli flag is flying at Ottawa City Hall today to mark the country's national day, with plans to hold a private ceremony to mark Israel's Independence Day. There is a significant police presence at City Hall, including security barriers outside the main doors.

Hot history: Tree rings show that last northern summer was the warmest since year 1

The broiling summer of 2023 was the hottest in the Northern Hemisphere in more than 2,000 years, a new study found.

What to pack during an emergency

Knowing what to have at home, or take with you for an evacuation, can be useful and even life-saving.