3 northeastern Ont. cities on the list for worst-kept homes in the province

Part of male construction worker. (File Photo/Image by gpointstudio on Freepik)

Part of male construction worker. (File Photo/Image by gpointstudio on Freepik)

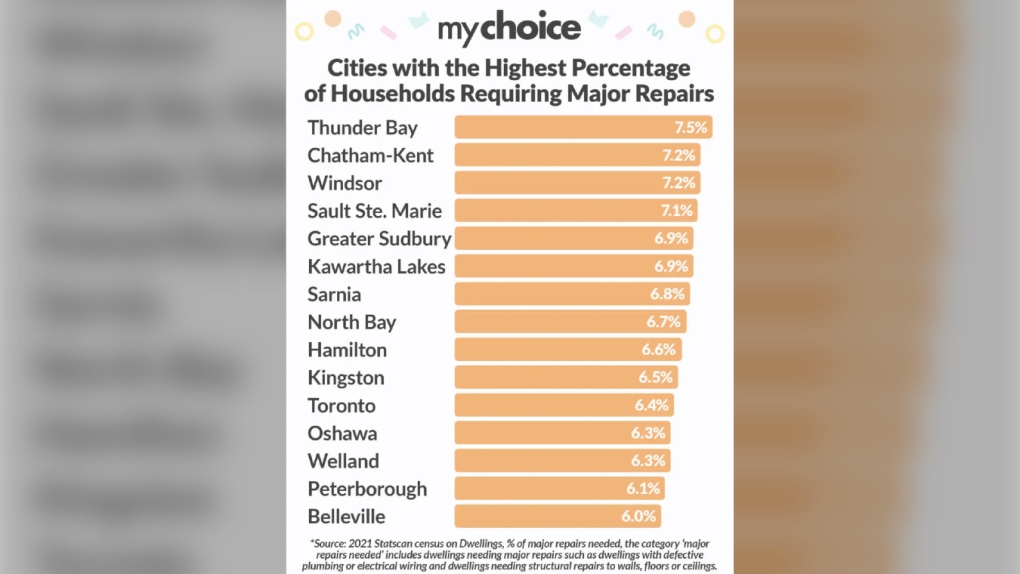

Three northeastern Ontario cities are on the list of the best and worst-kept homes in the province as compiled by a home insurance marketing blog.

MyChoice, an online company that markets home, auto and life insurance, said the list is based on 2021 Census data and shows percentages of Ontario homes that require major repairs – referring to significant issues such as defective plumbing, electrical wiring or structural repairs.

The company news release earlier this month said with the rise in HELOC (home equity line of credit) rates more and more homeowners are finding it difficult to manage home maintenance costs.

The disparities in home maintenance across the province may affect home insurance rates in Ontario-wide, according to MyChoice.

The company's recent study showed that Thunder Bay in northwestern Ontario was the city with the highest ratio of respondents in need of major repairs – 7.6 per cent of responses received indicated such.

On the opposite end of the list, the southern Ontario city of Vaughan, near Toronto, had only 2.5 per cent of homeowners indicate that repairs were needed.

The company’s complete list covers 42 larger communities across Ontario.

Three northeastern Ontario communities fell into the top 10 list of the worst-kept homes in the province. Sault Ste. Marie was fourth at 7.1 per cent with Sudbury just behind in fifth with 6.9 per cent and North Bay rounding out the top 10 worst-kept home listing with 6.7 per cent – no northern Ontario communities made the list of best-kept homes.

Three northeastern Ontario cities are on the list of the worst-kept homes in the province as compiled by MyChoice, an online company that markets home, auto and life insurance. (Supplied/MyChoice)

Three northeastern Ontario cities are on the list of the worst-kept homes in the province as compiled by MyChoice, an online company that markets home, auto and life insurance. (Supplied/MyChoice)

- Download the CTV News app now

- Get local breaking news alerts

- Daily newsletter with the top local stories emailed to your inbox

Aren Mirzaian, The CEO of MyChoice, Aren Mirzaian commented on the broader economic context the numbers provide.

"The upsurge in HELOC rates is just one piece of the puzzle,” he said.

“We're seeing the inflation of home insurance rates in Canada, which, according to the Q3 Consumer Price Index, home and mortgage insurance rates have increased by 8.6 per cent in 2023. The largest contributor to this would be rising home replacement costs due to inflation of building materials."

Mirzaian said that inflationary pressure on home insurance rates also corresponded to a period of heightened natural disasters in the country – resulting in an increase in insurance claims which has resulted in a rise in premiums.

“It’s imperative for homeowners to stay vigilant about their home’s condition and make sure they have the appropriate level of insurance coverage,” he said.

Other insurance experts agreed with Mirzaian’s assessment saying that properly maintaining a home to prevent minor issues can prevent larger issues from evolving and leading to more costly repairs.

CTVNews.ca Top Stories

Canadian team told Trump's tariffs unavoidable in short term in surprise Mar-a-Lago meeting

During a surprise dinner at Mar-a-Lago, representatives of the federal government were told U.S. tariffs from the incoming Donald Trump administration cannot be avoided in the immediate term, two government sources tell CTV News.

Toronto man accused of posing as surgeon, performing cosmetic procedures on several women

A 29-year-old Toronto man has been charged after allegedly posing as a surgeon and providing cosmetic procedures on several women.

Saskatoon priest accused of sexual assault says he meant to encourage young girl with hug and kiss

A Saskatoon priest accused of sexual assault says he meant to encourage and reassure a young girl when he hugged and kissed during his testimony at Saskatoon Provincial Court Friday.

Bob Bryar, drummer for rock band My Chemical Romance, dead at 44

Bob Bryar, former drummer for the band My Chemical Romance, has died. He was reportedly 44.

Trump threatens 100% tariff on the BRIC bloc of nations if they act to undermine U.S. dollar

U.S. president-elect Donald Trump on Saturday threatened 100 per cent tariffs against a bloc of nine nations if they act to undermine the U.S. dollar.

W5 Investigates 'I never took part in beheadings': Canadian ISIS sniper has warning about future of terror group

An admitted Canadian ISIS sniper held in one of northeast Syria’s highest-security prisons has issued a stark warning about the potential resurgence of the terror group.

'Disappointing': Toronto speed camera cut down less than 24 hours after being reinstalled

A Toronto speed camera notorious for issuing tens of thousands of tickets to drivers has been cut down again less than 24 hours after it was reinstalled.

Bruce the tiny Vancouver parrot lands internet fame with abstract art

Mononymous painter Bruce has carved a lucrative niche on social media with his abstract artworks, crafted entirely from the colourful juices of fruits.

Poilievre suggests Trudeau is too weak to engage with Trump, Ford won't go there

While federal Conservative Leader Pierre Poilievre has taken aim at Prime Minister Justin Trudeau this week, calling him too 'weak' to engage with U.S. president-elect Donald Trump, Ontario Premier Doug Ford declined to echo the characterization in an exclusive Canadian broadcast interview set to air this Sunday on CTV's Question Period.